In Driven: A Rita Mars Thriller, Rita spends time wading through corporate records, social media and online sources in her quest to identify the killer of her reporter friend, Bobby Ellis.

Why is this such a slavish task when we believe the Federal Election Commission (FEC) requires periodic reports that disclose the total amount of all contributions they receive, and the identity, address, occupation, and employer of any person who contributes more than $200 during a calendar year?

Secret contributions and dark money took on new freedoms in 1976 with the Buckley v. Valeo, landmark decision of the US Supreme Court on campaign finance. The justices held that limits on election spending in the Federal Election Campaign Act of 1971 were unconstitutional.

The Court ruled that expenditure limits contravened the First Amendment provision on freedom of speech because a restriction on spending for political communication necessarily reduces the quantity of expression. It limited disclosure provisions and limited the Federal Election Commission‘s power.

At the heart of this ruling and subsequent gaming of the system, is the shielding of donations via non-profits. These are the organizations given free rein: 501(c)(4) (“social welfare”), 501(c)(5) (unions) and 501(c)(6) (trade association) groups not to disclose donors. These groups receive unlimited donations from corporations, individuals and unions and not discloses to voters where the money came from.

Examples of 501(c)(4) are National Rifle Association, Planned Parenthood, Majority Forward, One Nation. 501(c)(5) examples are Service Employees International Union (SEIU), American Federation of Labor and Congress of Industrial Organizations (AFL-CIO), American Federation of State, County and Municipal Employees (AFSCME). Examples of

501(c)(6) include US Chamber of Commerce, American Bankers Association, National Association of Realtors.

Beyond the nondisclosure provision, Political Action Committees (PACs) frequently employ LLCs to disguise the identity of a donor or source of money spent on behalf of a political candidate.

LLCs are governed by state law but minimal information is necessary to file the required articles of incorporation. In states such as Delaware, New Mexico, Nevada and Wyoming, LLCs may be incorporated without reporting names of members or managers.

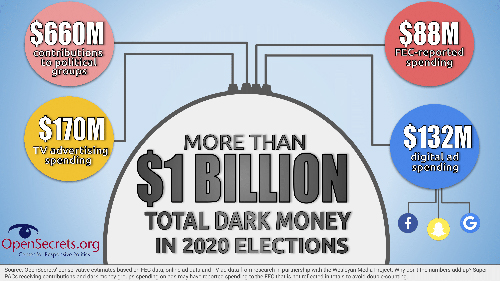

The lack of transparency helps disguise the source of millions of dollars in political spending. Shell LLC companies make major contributions to super PACs each election cycle, leaving voters in the dark while the recipient often knows the donor’s true identity. The influx of dark money jumped from around $5M in 2012 election to over $1B in the 2020 cycle.

So how can anyone like a Rita Mars get to the truth of backers/donors from these organizations when there is no comprehensive federal finance accountability legislation in place? There are some methods to put names to these mystery donors. Here is a list of tactics to track dark money expenditures:

- Researching IRS Form 990s using GuideStar

- Searching Securities and Exchange Commission (SEC) filings to find details of corporate contributions

- Cross referencing “voluntary corporate filings” (which are neither standardized nor comprehensive)

- Searching news articles for relevant information

- Explore Federal Election Commission (FEC) filings

- Labor union disclosures

Issue One, OpenSecrets, and PBS are all organizations that have conducted extensive research into dark money but they have only modest access to reveal the biggest spenders.